|

First of all, why should I do this? For me, it was about two things:

Wait a tick, how much will the taxes be?

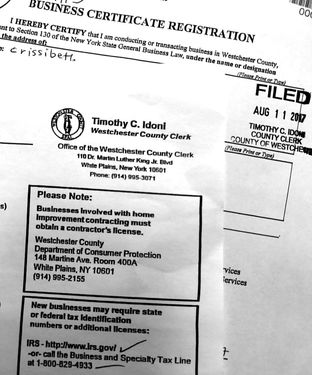

It depends, but a good rule of thumb is to set aside ⅓ of the income you make for taxes. That’s stupid high. But OK, back to what you were saying. So how do I register the name of my business? Five easy steps. I was in and out in less than 15 minutes. Didn’t even get a ticket for parking illegally. Wait what?

Congratulations! You’re officially registered! Why not celebrate? Celebrating is fun! Next thing I did was get an EIN (Employer Identification Number) from the IRS. Note: You do not need to have a DBA to get an EIN if you are just using your legal name and not a business name. Now why would I want to get an EIN? Again, for me, this was about the money / taxes. I wanted a business bank account to keep things separate, and the banks require an EIN. You can apply for one and get one immediately online here: Yay Instant Gratification! The IRS wants to make it as easy as possible for you to pay them money, so it’s really not a difficult process. I had mine within 10 minutes. When they ask you the questions with radio buttons, click “no” for all of them. They generate you an EIN and give you a PDF (I emailed it to myself). Then you take that into the bank with your DBA paperwork and they will get you set up with a business account. So how do I open a business account at the bank? I went to Bank of America because I already have a personal account there. I’m not specifically recommending them, but I’ll say this for them: they aren’t awful. I’m sure whatever bank you use has comparable options. I was able to open a business account with no monthly fee if I spent $250 on the account’s debit card or kept a minimum balance of $3,000. I had more than that to put in, and I figured I would try to pay for business expenses out of my business account with the debit card, so this worked out fine for me. Do I hafta do all this though? No, you probably don’t. If you work for yourself as a freelancer, and the companies make out checks to your legal name / wire money to your personal bank account, and you don’t have any employees, then you don’t have to register a DBA and you don’t have to get a business account. The IRS is just as pleased to take money from your personal accounts and you can use your personal social security number instead of an EIN. Just know if the company you are working for reports the money they paid you, you will have to pay taxes on it regardless of whether you are considered a business or not. At least if you’re set up as a business, you can deduct expenses from the crazy exorbitant taxes freelancers have to pay. If you have any questions at all, just let me know! I will try to answer based on my experience.

2 Comments

2/25/2021 03:40:11 am

Wow! Such a great article you have there especially now.I hope you will post more articles soon. Thank you.

Reply

Leave a Reply. |

@crissibethBlogging my path as a professional photojournalist / social media addict / influencer Archives

June 2023

Categories |

RSS Feed

RSS Feed